The Comprehensive Guide to Alternative Investment Strategies

The traditional “60/40” portfolio—a mix of 60% stocks and 40% bonds—was the gold standard for decades. However, in an era characterized by inflationary pressures, geopolitical instability, and extreme market volatility, relying solely on the public stock market is no longer a sufficient strategy for sophisticated wealth building. Smart investors are increasingly looking “beyond the ticker symbol” to find assets that offer low correlation to equities, provide steady cash flow, and act as a hedge against currency devaluation.

Investing beyond the stock market, often referred to as Alternative Investments, opens a vast world of opportunity. From the tangible security of real estate and the high-octane potential of private equity to the modern frontier of digital assets and the aesthetic value of fine art, these alternatives provide a necessary layer of diversification. By expanding your horizon, you aren’t just chasing higher returns; you are building a more resilient financial fortress capable of weathering economic storms that might sink a stock-only portfolio.

This deep-dive article explores the most effective alternative asset classes available today. We will analyze the mechanics, risks, and rewards of each category, providing you with the intellectual framework needed to transition from a traditional investor to a diversified portfolio architect.

The Case for Diversification: Why Go Alternative?

Before examining the “where,” we must understand the “why.” Why should an investor deal with the relative illiquidity and complexity of non-stock assets?

A. Reduced Correlation: The primary benefit of alternatives is their low correlation with the S&P 500 or NASDAQ. When the stock market crashes due to interest rate hikes or a tech sell-off, assets like farmland, gold, or private credit often remain stable or even increase in value. B. Inflation Protection: Tangible assets, particularly real estate and commodities, have intrinsic value. As the cost of living rises, the value of these physical assets typically follows suit, preserving your purchasing power. C. Enhanced Yield: In a low-interest-rate environment, traditional bonds often fail to beat inflation. Alternative investments like private debt or high-yield real estate syndications can offer significantly higher cash distributions. D. Access to Private Markets: Much of the world’s economic growth happens in private companies before they ever hit the public exchange. By the time a company IPOs, the “easy money” has often already been made by private equity and venture capital investors.

Real Estate: The Foundation of Alternative Wealth

Real estate is the oldest and most proven alternative asset class. It offers a unique combination of capital appreciation, tax advantages, and monthly cash flow.

A. Residential Rental Properties

This is the most direct way to invest. By owning single-family homes or multi-family units, you generate income through tenant rent. The beauty of residential real estate lies in its leverage; you can control a $500,000 asset with only $100,000 of your own capital, while the tenant pays down your mortgage.

B. Commercial Real Estate (CRE)

CRE involves investing in office buildings, retail strips, and warehouses. These often come with “Triple Net Leases” (NNN), where the tenant pays for taxes, insurance, and maintenance, providing the investor with a hands-off, “mailbox money” experience.

C. Real Estate Investment Trusts (REITs)

For those who want real estate exposure without the “toilets, tenants, and trash,” REITs are the answer. These companies own and manage portfolios of properties. Public REITs trade like stocks, while private REITs offer less liquidity but often higher yields and lower volatility.

D. Farmland and Timberland

Often overlooked, agricultural land is a “boring” but brilliant investment. People always need to eat, and the amount of arable land is shrinking. Farmland has historically outperformed many other asset classes with almost zero correlation to the stock market.

Private Equity and Venture Capital: Buying the Future

If stocks represent owning a tiny slice of a public giant, Private Equity (PE) and Venture Capital (VC) represent owning a significant stake in the giants of tomorrow.

A. Venture Capital (VC): This involves funding early-stage startups with high growth potential. While the risk of failure is high, a single “home run” investment in the next Uber or Airbnb can return 100x your initial capital. B. Private Equity (PE): PE firms typically buy established, underperforming private companies, optimize their operations, and sell them for a profit or take them public. It is a game of operational excellence and long-term value creation. C. Equity Crowdfunding: Thanks to the JOBS Act, non-accredited investors can now participate in early-stage investing through platforms like Wefunder or Republic, allowing everyday people to act as “mini-VCs.”

Hard Assets and Commodities: The Power of Tangibility

When paper money feels uncertain, investors flock to things they can touch. Hard assets provide a psychological and financial safety net.

A. Precious Metals (Gold and Silver)

Gold has been a store of value for over 5,000 years. It is the ultimate hedge against “black swan” events and systemic financial collapse. While it doesn’t pay a dividend, its role as a “crisis commodity” makes it an essential component of a diversified portfolio.

B. Energy and Industrial Metals

Investing in oil, natural gas, copper, and lithium is a bet on global infrastructure and the green energy transition. As the world shifts to electric vehicles, the demand for lithium and copper is projected to skyrocket, potentially creating a “super-cycle” for these commodities.

C. Fine Art and Collectibles

The blue-chip art market (think Picasso, Basquiat, or Warhol) has historically outperformed the S&P 500. Art is an “ultra-alternative” because its value is driven by scarcity and cultural significance rather than corporate earnings. Fractional platforms now allow investors to buy “shares” of a masterpiece.

The Digital Frontier: Cryptocurrencies and Decentralized Finance

No discussion of modern alternatives is complete without mentioning digital assets. While volatile, the underlying technology—blockchain—is a fundamental innovation.

A. Bitcoin (Digital Gold): Bitcoin is increasingly viewed as a decentralized, digital version of gold. With a capped supply of 21 million, it serves as a hedge against the infinite printing of fiat currency. B. Ethereum and Smart Contracts: Ethereum is more than a currency; it is a global computer. By investing in Ethereum, you are betting on the “Web3” ecosystem, including decentralized finance (DeFi) and non-fungible tokens (NFTs). C. Staking and Yield Farming: In the digital world, you can “work” your assets. By staking your tokens to secure a network, you can earn “rewards” that function similarly to interest or dividends, often reaching double-digit percentages.

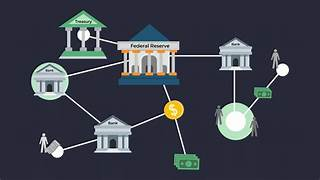

Private Credit: Becoming the Bank

As traditional banks have tightened their lending standards, a massive “shadow banking” market has emerged. Private credit involves lending money directly to companies or individuals.

A. Peer-to-Peer (P2P) Lending: Platforms like Prosper or LendingClub allow you to lend small amounts to individuals for debt consolidation or home improvement, earning the interest that would usually go to a bank. B. Direct Lending to SMEs: Many small and medium-sized enterprises (SMEs) cannot get bank loans despite being profitable. Private credit funds step in to fill this gap, offering investors high-single-digit or low-double-digit returns backed by corporate assets. C. Real Estate Debt: Instead of buying the building, you can “be the bank” by providing bridge loans or construction financing to developers, secured by a first-lien position on the property.

Navigating Risks and Illiquidity

Alternative investments are not a “free lunch.” They come with specific trade-offs that every investor must acknowledge.

- A. Illiquidity: Unlike a stock you can sell in seconds, many alternatives require you to lock up your money for 3, 5, or even 10 years. You must ensure you have a sufficient “emergency fund” in liquid assets before venturing into alternatives.

- B. Higher Fees: Managing a private equity fund or an art collection is more expensive than running a low-cost Vanguard ETF. Expect to see management fees and performance fees (carried interest).

- C. Information Asymmetry: In the stock market, all public information is available to everyone. In alternatives, the “deal flow” often goes to those with the best networks. You must do significant due diligence to ensure you aren’t on the wrong side of a trade.

- D. Regulatory Risk: Asset classes like crypto or certain private placements are subject to changing government regulations which can impact value overnight.

The Modern Portfolio: How to Allocate

How much of your wealth should move beyond the stock market? While every situation is unique, a common “Modern Portfolio” allocation for aggressive growth might look like this:

- Stocks (Equities): 40-50%

- Bonds/Cash: 10-15%

- Real Estate: 15-20%

- Private Equity/VC: 10%

- Commodities/Gold: 5%

- Digital Assets: 5%

This structure ensures that you are participating in the growth of the public markets while protecting yourself through uncorrelated, tangible, and high-yield alternatives.

Conclusion: Wealth is Built Beyond the Ticker

The transition from a “retail investor” to a “wealth manager” requires a shift in perspective. The stock market is a fantastic tool for liquidity and general growth, but true generational wealth is almost always anchored in private deals, physical land, and scarce assets.

By diversifying into alternatives, you are moving away from a strategy of “hoping the market goes up” to a strategy of “owning assets that produce value regardless of the market.” Whether it is the steady rent from an apartment complex, the explosive growth of a tech startup, or the timeless security of gold, the world beyond the stock market offers the tools you need to achieve genuine financial independence. Start small, do your homework, and begin building a portfolio that can stand the test of time.