Mastering the Economics: How Central Banks Control Money

The global economy is often viewed as a chaotic, unpredictable ocean, but beneath the surface, there are powerful entities acting as the ultimate navigators. These are the central banks. From the Federal Reserve (Fed) in the United States to the European Central Bank (ECB) and the Bank of Japan, these institutions possess a level of influence that dictates the financial fate of billions. Every time you buy a house, swipe a credit card, or check your savings account balance, you are feeling the ripple effects of a decision made behind the closed doors of a central bank boardroom.

To the average person, the term “monetary policy” sounds like abstract jargon reserved for academics and Wall Street titans. However, the reality is far more personal. Central banks are the architects of your purchasing power. They have the power to make your debt cheaper or more expensive, to stimulate job growth, or to intentionally slow down the economy to prevent it from overheating. In a world of fluctuating inflation and shifting job markets, understanding how these institutions operate is no longer optional—it is a survival skill for anyone looking to master their personal finances.

This comprehensive guide pulls back the curtain on the mechanics of central banking. We will explore the primary tools they use to manipulate the economy, the delicate balancing act between inflation and employment, and, most importantly, the direct, tangible ways their policies impact your wallet, your investments, and your long-term wealth.

The Mandate: The Dual Mission of Central Banks

Most major central banks operate under what is known as a “dual mandate.” While the specific wording varies by country, their primary objectives generally center on two pillars:

A. Price Stability (Targeting Inflation): Central banks strive to keep inflation low and predictable. Most developed nations target an annual inflation rate of approximately 2%. This level is considered the “Goldilocks” zone—high enough to encourage spending and investment, but low enough that people don’t lose faith in the value of their currency.

B. Maximum Sustainable Employment: The second pillar is to foster an economic environment where as many people as possible who want a job can find one. By adjusting the cost of money, central banks can either encourage businesses to expand and hire or force them to tighten their belts.

The Toolkit: How Central Banks Move the Needle

Central banks do not have a “make the economy better” button. Instead, they use a specific set of levers to influence how much money is flowing through the system.

A. The Federal Funds Rate (Interest Rate Manipulation)

This is the most famous tool in the shed. The “policy rate” is the interest rate at which commercial banks lend to each other overnight. It serves as the baseline for all other interest rates in the economy.

- When rates are lowered: Borrowing becomes cheaper. Businesses take out loans to build factories, and consumers take out mortgages to buy homes. This “cheap money” stimulates economic activity.

- When rates are raised: Borrowing becomes expensive. It costs more to carry credit card debt or finance a car. This “tight money” is used to cool down an economy that is growing too fast and generating too much inflation.

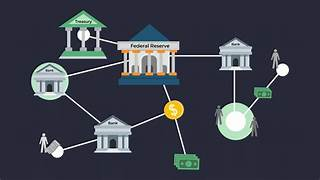

B. Open Market Operations (OMO)

This involves the buying and selling of government bonds in the open market. When a central bank buys bonds, it injects “fresh” cash into the banking system, increasing the money supply. When it sells bonds, it sucks cash out of the system, effectively shrinking the money supply.

C. Quantitative Easing (QE) and Tightening (QT)

In extreme scenarios, such as the 2008 financial crisis or the COVID-19 pandemic, standard interest rate cuts aren’t enough. Central banks turn to Quantitative Easing. This is essentially “printing money” (digitally) to buy long-term assets like government bonds and mortgage-backed securities. This floods the system with liquidity and lowers long-term interest rates. Quantitative Tightening is the opposite—the bank stops buying or starts selling these assets to reduce the money supply.

D. Reserve Requirements

Central banks dictate exactly how much cash a commercial bank must hold in its vaults (or at the central bank) relative to its deposits. By lowering this requirement, banks can lend out more money. By raising it, the central bank restricts the amount of credit available in the economy.

How Central Bank Decisions Hit Your Personal Finances

Now that we understand the “how,” let’s look at the “so what?” How does a meeting in Washington D.C. or Frankfurt actually change your life?

A. The Cost of Debt (Mortgages and Loans)

The most direct impact is felt in your borrowing costs. Most consumer loans are tied to a benchmark rate. When the central bank raises rates:

- Mortgages: Rates on new home loans climb. On a $400,000 mortgage, a 2% increase in interest can mean hundreds of dollars more in monthly payments and over $100,000 in extra interest over the life of the loan.

- Credit Cards: Most credit cards have variable Annual Percentage Rates (APRs). When the Fed moves, your credit card interest usually follows within one or two billing cycles.

- Auto Loans: Financing a vehicle becomes more expensive, often leading to a slowdown in the automotive industry.

B. Your Savings and “Safe” Investments

For savers, central bank policy is a double-edged sword. During the “cheap money” era (2009–2021), savings accounts and Certificates of Deposit (CDs) paid almost zero interest. Savers were effectively punished. However, when central banks raise rates to fight inflation, the yields on high-yield savings accounts and Treasury bonds rise. This allows conservative investors to earn a respectable return without taking on the risks of the stock market.

C. The Stock Market and Asset Valuations

The stock market generally has an inverse relationship with interest rates.

- Discount Rates: Investors value companies based on the present value of their future earnings. When interest rates (the “discount rate”) go up, those future earnings are worth less today, often leading to lower stock prices.

- The “TINA” Factor: “There Is No Alternative.” When interest rates are zero, investors are forced into the stock market to get any return. When rates rise, “safe” bonds become an attractive alternative, causing money to flow out of stocks and into fixed income.

D. Your Purchasing Power (Inflation)

Central banks are the primary guardians of your wallet’s value. If they are too “dovish” (keep rates too low for too long), the money supply grows too fast, leading to inflation. Suddenly, your salary doesn’t cover as many groceries, and your rent skyrockets. Conversely, if they are too “hawkish” (raise rates too aggressively), they can cause a recession, which leads to job losses and stagnant wages.

The Ripple Effect: Currency Strength and Global Trade

Central bank policy also dictates the strength of a nation’s currency on the global stage.

A. Attracting Foreign Capital: When a central bank raises interest rates, that country’s currency usually strengthens. Why? Because global investors want to move their money into that currency to earn those higher yields.

B. Impact on Imports and Exports: A “strong” currency makes foreign goods (imports) cheaper for you. However, it makes a country’s exports more expensive for foreigners, which can hurt domestic manufacturers. Conversely, a “weak” currency makes your country a bargain for tourists and foreign buyers but makes your trip to Europe or your purchase of a foreign car much more expensive.

The Psychological Game: Forward Guidance

One of the most underrated tools of a central bank is Forward Guidance. This is essentially the “art of talking.” By giving speeches and publishing projections, central bank leaders signal what they intend to do in the future.

If the head of the central bank says, “We expect to keep rates high for a long time,” markets react immediately, even before any official action is taken. This transparency is designed to prevent market shocks and allow businesses and consumers to plan accordingly. However, if the “guidance” is unclear, it can lead to massive market volatility as investors try to read the tea leaves.

Case Study: The Post-Pandemic Inflation Spike

To see these mechanics in action, we only need to look at the global economy from 2020 to 2024.

- The Stimulus (2020–2021): To prevent a global depression during lockdowns, central banks slashed rates to zero and engaged in massive QE.

- The Overheating: Combined with supply chain disruptions, this flood of money led to the highest inflation in 40 years.

- The Pivot (2022–2023): Realizing inflation was not “transitory,” central banks began a historic series of rate hikes.

- The Result: Mortgage rates jumped from 3% to 7%, the tech stock bubble cooled, and the “cost of living crisis” became the dominant global headline.

Strategies for the Individual Investor

How should you position yourself in response to central bank movements?

A. Watch the Fed: Even if you don’t live in the U.S., the Federal Reserve is the de facto central bank of the world. Its decisions move the U.S. Dollar, which is the global reserve currency.

B. Match Your Debt to the Cycle: In a low-rate environment, it’s wise to lock in long-term, fixed-rate debt (like a 30-year mortgage). In a high-rate environment, you should focus on paying down variable-rate debt (like credit cards) as quickly as possible.

C. Diversify for Inflation: If you suspect the central bank is losing the war on inflation, consider assets that traditionally hold value, such as real estate, commodities (gold/oil), or inflation-protected securities (TIPS).

D. Stay Liquid: Central bank pivots can cause sudden shifts in asset prices. Keeping a healthy emergency fund in a high-yield savings account ensures you aren’t forced to sell stocks or property during a temporary market downturn caused by a rate hike.

The Invisible Hand of the 21st Century

Central banks are often criticized for being “unelected bureaucrats,” yet their influence on our daily lives is undeniable. They are the managers of the economic weather. While they cannot control every variable—such as geopolitical conflicts or technological breakthroughs—they control the temperature of the room.

By understanding the mechanics of interest rates, the goals of monetary policy, and the indicators that central banks watch (like the Consumer Price Index and unemployment data), you move from being a passive victim of the economy to an active, informed participant. You can anticipate when it’s time to save, when it’s time to borrow, and how to protect your hard-earned wealth from the eroding power of inflation. In the modern financial era, the central bank isn’t just an institution; it’s the heartbeat of your financial world.