Stop Saving, Start Building Wealth Now

The traditional financial advice our parents followed is dead. For decades, the mantra was simple: work hard, save 10% of your income in a high-yield savings account, and retire comfortably at sixty-five. In the mid-20th century, this was a viable path. Inflation was manageable, housing was affordable, and interest rates on savings accounts actually outpaced the rising cost of living. But today, “saving” is a slow-motion trap. If you are merely stockpiling cash in a traditional bank account, you aren’t just standing still—you are actively losing money.

The global economy has shifted into a paradigm where currency debasement and rising inflation are the norms. With inflation rates frequently exceeding the nominal interest paid by banks, the purchasing power of your hard-earned dollars evaporates year after year. To achieve true financial independence, you must undergo a radical mindset shift. You must stop being a “saver” and start becoming an “investor.” You must move from a defensive posture of hoarding cash to an offensive strategy of building a portfolio of productive assets. This guide will dismantle the myth of saving and provide a comprehensive, 2000-word blueprint for modern wealth creation.

The Hidden Cost of “Safety”: Why Saving Fails

The psychological comfort of seeing a large balance in a savings account is undeniable. It feels “safe.” However, in the world of finance, this is a dangerous illusion known as “cash drag.”

A. The Erosion of Purchasing Power: Inflation is the silent thief. If inflation is at 4% and your bank pays you 0.5% interest, you are losing 3.5% of your wealth’s value every single year. Over a decade, this compounded loss can be devastating.

B. Opportunity Cost: Every dollar sitting idle in a savings account is a dollar that isn’t working for you. In the world of wealth building, money is a soldier. If your soldiers are sitting in the barracks (savings), they aren’t capturing new territory (returns). By avoiding market volatility, you are essentially paying a massive “safety tax” in the form of missed compounded growth.

C. The Psychology of Scarcity: Saving is often rooted in a scarcity mindset—the fear that there isn’t enough. Building wealth requires an abundance mindset—the understanding that capital can be deployed to create more value.

The Foundations of Productive Asset Allocation

Wealth is not determined by how much money you have, but by how many assets you own that generate cash flow or appreciate in value. To start building wealth, you must understand the hierarchy of asset classes.

A. The Power of Public Equities (Stocks)

Investing in the stock market remains the most accessible way for the average person to participate in global economic growth. When you buy a stock, you aren’t just gambling on a ticker symbol; you are buying a piece of a living, breathing business.

- Index Fund Strategy: For most people, trying to “beat the market” is a fool’s errand. Investing in low-cost S&P 500 or Total Market index funds allows you to capture the historical 7-10% average annual return of the market.

- Dividend Growth Investing: This involves buying shares in companies that not only increase in value but also pay you a portion of their profits regularly. This creates a “snowball effect” where dividends are reinvested to buy more shares, which in turn pay more dividends.

B. Real Estate: The Great Wealth Multiplier

Real estate has minted more millionaires than perhaps any other asset class. Its power lies in four distinct pillars:

- Cash Flow: The monthly rent paid by tenants after all expenses are covered.

- Appreciation: The increase in the property’s value over time.

- Leverage: The ability to use the bank’s money (a mortgage) to control a much larger asset, magnifying your returns on equity.

- Tax Advantages: Depreciation and 1031 exchanges allow real estate investors to shield a significant portion of their income from the IRS.

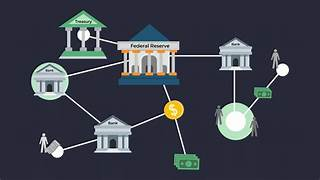

C. Fixed Income and Private Credit

While traditional savings accounts fail, private credit and high-yield bonds can provide a middle ground for those seeking income with slightly higher risk. This includes Peer-to-Peer (P2P) lending or investing in corporate debt funds that yield significantly higher than a standard CD.

The Mechanics of Compounding: Your Greatest Ally

Albert Einstein famously called compound interest the “eighth wonder of the world.” To build wealth, you must understand the mathematical formula that governs it. The formula for compound interest is:

$$A = P \left(1 + \frac{r}{n}\right)^{nt}$$

Where:

- $A$ = the future value of the investment

- $P$ = the principal investment amount

- $r$ = the annual interest rate (decimal)

- $n$ = the number of times that interest is compounded per year

- $t$ = the number of years the money is invested

The most critical variable in this equation isn’t $r$ (the rate) or $P$ (the principal)—it is $t$ (time). This is why you must start building wealth now. Waiting just five years to start investing can result in hundreds of thousands of dollars in lost gains by the time you reach retirement age.

Strategic Debt: Distinguishing Between Good and Bad

To build wealth, you must master the use of debt. Most savers view all debt as a burden. Wealth builders view debt as a tool.

A. Consumer Debt (The Wealth Killer): Credit card debt, high-interest auto loans, and payday loans are “bad debt.” They carry high interest rates that work against you, effectively reverse-compounding your wealth into the pockets of banks. These must be eliminated immediately.

B. Investment Debt (The Wealth Accelerator): “Good debt” is low-interest debt used to acquire an asset that produces a higher return than the cost of the debt. A 6% mortgage on a rental property that yields a 10% total return is a winning trade. This is called “arbitrage,” and it is how the wealthy scale their empires.

Tax Optimization: It’s Not What You Make, It’s What You Keep

The biggest expense you will ever face is not your mortgage or your car—it is taxes. Building wealth requires a “tax-first” approach to every financial decision.

- Tax-Advantaged Accounts: You must maximize contributions to 401(k)s, IRAs, and HSAs. These accounts allow your investments to grow either tax-deferred or tax-free (in the case of a Roth IRA).

- Capital Gains Management: Holding assets for longer than a year qualifies you for long-term capital gains tax rates, which are significantly lower than ordinary income tax rates.

- Asset Location: Place high-dividend or high-turnover investments in tax-advantaged accounts while keeping tax-efficient index funds in standard brokerage accounts.

The Entrepreneurial Leap: Equity Over Salary

While investing in the stock market is vital, the fastest path to massive wealth is through equity ownership in a private business. A salary is a trade of your time for money—a linear relationship. Equity is a claim on future value—an exponential relationship.

A. The Side Hustle to Scalable Business: In the digital age, the barrier to entry for starting a business is near zero. Whether it’s an e-commerce store, a consulting firm, or a digital content platform, creating a “cash flow engine” that operates independently of your time is a critical pillar of wealth.

B. Investing in Private Equity: For those who don’t want to run their own business, “Angel Investing” or “Equity Crowdfunding” allows you to buy stakes in early-stage startups. While high-risk, a single “home run” in this space can generate returns that dwarf a lifetime of traditional saving.

Overcoming the “Savings Trap” Psychology

Moving from saving to building wealth requires overcoming deep-seated psychological biases.

- Loss Aversion: Humans feel the pain of a loss twice as much as the joy of a gain. This causes people to stay in “safe” cash even when it’s objectively a poor financial move. You must train yourself to see “volatility” as the price of admission for “returns.”

- The Lure of Lifestyle Creep: As your income increases, your expenses tend to follow. To build wealth, you must maintain a “wealth-building gap”—the difference between what you earn and what you spend. Instead of upgrading your car when you get a raise, upgrade your investment contributions.

- Information Overload: The 24-hour news cycle thrives on fear. “The market is crashing!” “A recession is coming!” Wealth builders ignore the noise. They understand that time in the market is more important than timing the market.

Actionable Steps to Start Today

If you are ready to stop saving and start building, follow this sequence:

A. Build a “Lean” Emergency Fund: Do not keep six months of expenses in a zero-interest account. Keep one to two months of “survival cash” and put the rest of your “emergency fund” into a liquid, low-risk brokerage account or a high-yield money market fund.

B. Automate the Gap: Set up an automatic transfer from your paycheck to your investment accounts. If you don’t see the money, you won’t spend it.

C. Educate Your Greatest Asset: Your mind is your most productive asset. Invest in books, courses, and seminars that teach you high-value skills and sophisticated investment strategies.

D. Diversify Beyond Currency: Own “hard assets.” This includes real estate, precious metals, or even digital assets like Bitcoin, which serve as a hedge against the inevitable debasement of fiat currency.

The Future Belongs to the Bold

The era of the passive saver is over. The global financial system is no longer designed to reward those who squirrel away cash in a vault. It is designed to reward those who take calculated risks, those who provide value to the marketplace, and those who own the means of production.

Building wealth is not about being “greedy.” It is about achieving the freedom to live life on your own terms, to support the causes you believe in, and to provide a legacy for your family. It requires discipline, education, and the courage to step away from the herd. The path is clear: Stop saving for a rainy day and start building a ship that can sail through any storm. Your future self will thank you for the risks you took today.