The New Rules of Global Finance: 2025 Edition

The global financial landscape is no longer a monolith governed by the traditional power centers of the West. We have entered an era of profound fragmentation, rapid digitalization, and a fundamental reassessment of what constitutes “value.” For decades, the “old rules”—defined by the hegemony of the US dollar, the centralized authority of the IMF and World Bank, and the predictable flow of capital from developed to emerging markets—provided a stable, albeit imperfect, framework for international trade and investment. Today, that framework is being dismantled and replaced by a complex, multi-polar, and increasingly tech-driven system.

For investors, policymakers, and business leaders, understanding these “New Rules” is not merely an academic exercise; it is a prerequisite for financial survival. We are witnessing the rise of Central Bank Digital Currencies (CBDCs), the weaponization of finance in geopolitical conflicts, and a massive shift toward sustainable investing that is reshaping capital allocation globally. The following analysis explores the core pillars of this new financial order, providing the depth and clarity needed to navigate the challenges and opportunities of 2025 and beyond.

The Multi-Polar Monetary System: Beyond Dollar Dominance

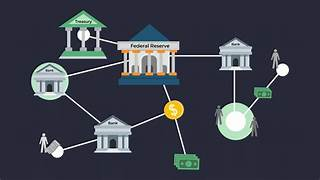

For nearly a century, the US dollar has been the world’s primary reserve currency, providing the United States with “exorbitant privilege.” However, the new rules of global finance suggest a move toward a more fragmented monetary world.

A. The Rise of Alternative Settlement Systems: Sanctions and geopolitical tensions have accelerated the development of non-dollar payment rails. Countries are increasingly exploring “de-dollarization” not out of a desire to destroy the dollar, but to insulate themselves from US policy. B. Currency Diversification in Central Banks: While the dollar remains dominant, its share in global foreign exchange reserves is gradually declining. Central banks are diversifying into the Euro, the Japanese Yen, and increasingly, the Chinese Renminbi (Yuan), alongside a significant return to Gold. C. Bilateral Trade Agreements: We are seeing a surge in agreements where countries settle trade in their local currencies. This reduces reliance on the SWIFT system and diminishes the demand for dollars in international transactions.

Digital Transformation: The Programmable Money Revolution

The most visible change in the new financial rules is the transition from analog to digital value. This isn’t just about faster transactions; it’s about the fundamental nature of money itself.

A. Central Bank Digital Currencies (CBDCs): Over 90% of the world’s central banks are currently exploring or piloting CBDCs. Unlike decentralized cryptocurrencies, CBDCs are digital forms of a nation’s fiat currency. They offer the potential for real-time settlement, reduced transaction costs, and greater financial inclusion, but they also raise significant concerns regarding privacy and government surveillance. B. The Institutionalization of Digital Assets: Bitcoin and Ethereum have moved from the periphery to the core of institutional portfolios. The approval of spot ETFs and the development of clear regulatory frameworks in major financial hubs have turned digital assets into a legitimate asset class. C. Tokenization of Real-World Assets (RWA): One of the most transformative “new rules” is the tokenization of traditional assets like real estate, bonds, and private equity. By putting these assets on a blockchain, markets gain 24/7 liquidity, fractional ownership, and automated compliance through smart contracts.

The ESG Mandate: Capital with a Conscience

The era of “profit at any cost” is over. Under the new rules, Environmental, Social, and Governance (ESG) criteria are no longer optional “feel-good” metrics; they are core components of risk management and valuation.

A. Regulatory Compression: From the EU’s Sustainable Finance Disclosure Regulation (SFDR) to the SEC’s climate disclosure rules, governments are forcing transparency. Companies must now report their carbon footprints and social impact with the same rigor as their balance sheets. B. The Great Wealth Transfer: As trillions of dollars pass to Millennials and Gen Z, capital is being reallocated based on values. These generations prioritize sustainability, forcing investment funds to pivot their strategies to maintain their assets under management (AUM). C. Green Finance and Transition Bonds: The “New Rules” have created massive new markets. Green bonds are now a trillion-dollar industry, providing the capital necessary for the global transition to a low-carbon economy.

Geopolitics as a Financial Variable

In the past, finance and geopolitics were often viewed as separate spheres. Today, they are inextricably linked. The “New Rules” dictate that geopolitical risk is now a primary financial risk.

A. Friend-Shoring and Near-Shoring: Capital flows are no longer just following the lowest cost of labor. They are following political alliances. “Friend-shoring”—the practice of sourcing and investing only in politically aligned nations—is reshaping global supply chains and investment patterns. B. The Weaponization of Finance: The freezing of central bank reserves and the exclusion of major economies from global payment systems have changed the risk perception of holding foreign assets. This has led to a “balkanization” of global finance, where different blocs develop their own localized rules and standards. C. The End of Globalized Tech Finance: The rivalry between the US and China is creating a “splinternet” in fintech. We are seeing two distinct ecosystems of apps, payment processors, and data standards emerging, forcing global companies to choose sides or operate complex, bifurcated systems.

Inflation and the New Interest Rate Paradigm

The “New Rules” mark the definitive end of the era of “Lower for Longer.” We have moved into a period of structurally higher inflation and interest rates.

A. The End of Cheap Labor and Energy: Globalization previously acted as a massive deflationary force by providing cheap labor and energy. With the rise of protectionism and the costly transition to green energy, those deflationary tailwinds have turned into inflationary headwinds. B. Active Central Banking: Central banks have shifted from a reactive stance to a more proactive, and sometimes aggressive, approach to inflation targeting. This means higher volatility in bond markets and a reassessment of the “60/40” portfolio model. C. The Rise of Real Assets: In an inflationary world, the “New Rules” favor tangible assets. Commodities, infrastructure, and real estate are becoming essential hedges against the eroding purchasing power of fiat currency.

Financial Technology: The Democratization of Wealth

The gatekeepers of the financial world—the big banks and brokerage houses—are losing their monopoly. The “New Rules” are being written by fintech disruptors.

A. The Death of Traditional Banking Intermediation: Peer-to-peer (P2P) lending, decentralized finance (DeFi), and neo-banks are allowing consumers and businesses to bypass traditional banks. This is lowering costs and increasing the speed of capital movement. B. AI-Driven Wealth Management: Artificial Intelligence is democratizing high-level financial advice. Quant-style investing and sophisticated tax-loss harvesting, once reserved for the ultra-wealthy, are now available to retail investors through robo-advisors and AI-integrated platforms. C. Embedded Finance: Finance is becoming invisible. Whether it’s “Buy Now, Pay Later” (BNPL) at a checkout screen or insurance bundled with a car purchase, financial services are being integrated directly into non-financial platforms.

The Future of Corporate Finance and Treasury

For corporations, the “New Rules” require a radical rethink of how they manage their balance sheets.

A. Liquidity as a Strategic Weapon: In a volatile, high-interest-rate environment, cash is no longer “trash.” Companies are maintaining larger liquidity buffers to navigate sudden geopolitical shifts or credit crunches. B. Dynamic Hedging: With currency volatility at multi-year highs, corporate treasurers are using more sophisticated AI-driven tools to hedge their exposure in real-time. C. Decentralized Treasury Management: Some forward-thinking companies are starting to hold portions of their treasury in digital assets or stablecoins to facilitate faster cross-border payments and earn higher yields than traditional money market accounts.

Adapting to the New Order

The transition to the “New Rules of Global Finance” is not a single event but an ongoing evolution. The centralized, Western-led system of the 20th century is giving way to a decentralized, digital, and multi-polar reality. This shift brings significant risks—increased volatility, geopolitical friction, and regulatory uncertainty. However, it also brings unprecedented opportunities for those who can leverage new technologies, adapt to sustainable mandates, and navigate a more complex geopolitical landscape.

The winners in this new era will be those who embrace flexibility over dogma. Whether you are an individual investor or a CFO of a multinational corporation, the message is clear: the old playbook is obsolete. To thrive, you must master the digital rails of modern money, account for the true cost of environmental impact, and recognize that in the 21st century, every financial decision is also a geopolitical one.